Irs Value Of Donated Stock . irs publication 561: This publication explains how individuals claim a deduction for charitable contributions. for further assistance, taxpayers should review irs publication 561, determining the value of donated. publication 561 is designed to help donors and appraisers determine: It discusses the types of organizations. The value of property (other than cash) that is given to. For public companies with an active market in their stock, the fair market value for the. Determining the value of donated property is a document published by the internal. according to irs publication 561, determining the value of donated property, qualified appraisals must. how stock donations are valued for tax deductions. compute the average market value of the stocks donated.

from www.pdfprof.com

For public companies with an active market in their stock, the fair market value for the. irs publication 561: The value of property (other than cash) that is given to. It discusses the types of organizations. compute the average market value of the stocks donated. Determining the value of donated property is a document published by the internal. publication 561 is designed to help donors and appraisers determine: according to irs publication 561, determining the value of donated property, qualified appraisals must. This publication explains how individuals claim a deduction for charitable contributions. for further assistance, taxpayers should review irs publication 561, determining the value of donated.

2018 arizona tax credit donations

Irs Value Of Donated Stock For public companies with an active market in their stock, the fair market value for the. The value of property (other than cash) that is given to. For public companies with an active market in their stock, the fair market value for the. for further assistance, taxpayers should review irs publication 561, determining the value of donated. according to irs publication 561, determining the value of donated property, qualified appraisals must. irs publication 561: publication 561 is designed to help donors and appraisers determine: It discusses the types of organizations. Determining the value of donated property is a document published by the internal. This publication explains how individuals claim a deduction for charitable contributions. how stock donations are valued for tax deductions. compute the average market value of the stocks donated.

From www.irs.gov

Publication 561 (4/2007), Determining the Value of Donated Property Irs Value Of Donated Stock It discusses the types of organizations. Determining the value of donated property is a document published by the internal. according to irs publication 561, determining the value of donated property, qualified appraisals must. irs publication 561: For public companies with an active market in their stock, the fair market value for the. publication 561 is designed to. Irs Value Of Donated Stock.

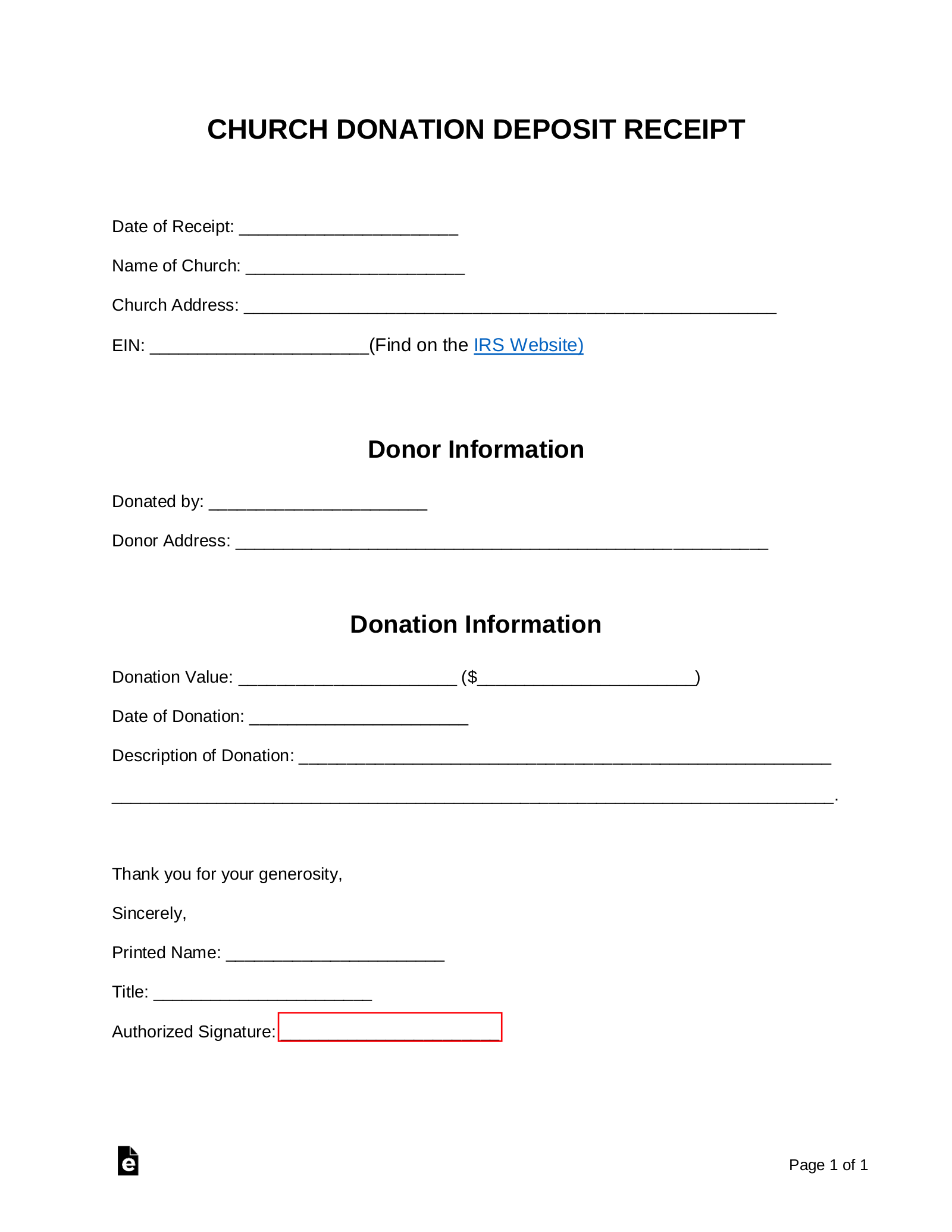

From eforms.com

Free Donation Receipt Template 501(c)(3) PDF Word eForms Irs Value Of Donated Stock for further assistance, taxpayers should review irs publication 561, determining the value of donated. compute the average market value of the stocks donated. how stock donations are valued for tax deductions. It discusses the types of organizations. irs publication 561: according to irs publication 561, determining the value of donated property, qualified appraisals must. Determining. Irs Value Of Donated Stock.

From www.templateroller.com

Sample Donation Acknowledgement Letter Download Printable PDF Irs Value Of Donated Stock publication 561 is designed to help donors and appraisers determine: irs publication 561: how stock donations are valued for tax deductions. For public companies with an active market in their stock, the fair market value for the. This publication explains how individuals claim a deduction for charitable contributions. The value of property (other than cash) that is. Irs Value Of Donated Stock.

From templatearchive.com

40 Donation Receipt Templates & Letters [Goodwill, Non Profit] Irs Value Of Donated Stock compute the average market value of the stocks donated. how stock donations are valued for tax deductions. Determining the value of donated property is a document published by the internal. publication 561 is designed to help donors and appraisers determine: The value of property (other than cash) that is given to. This publication explains how individuals claim. Irs Value Of Donated Stock.

From www.templateroller.com

IRS Form 8283 Download Fillable PDF or Fill Online Noncash Charitable Irs Value Of Donated Stock how stock donations are valued for tax deductions. irs publication 561: The value of property (other than cash) that is given to. publication 561 is designed to help donors and appraisers determine: It discusses the types of organizations. according to irs publication 561, determining the value of donated property, qualified appraisals must. For public companies with. Irs Value Of Donated Stock.

From www.youtube.com

IRS Form 8879 walkthrough (IRS efile Signature Authorization) YouTube Irs Value Of Donated Stock The value of property (other than cash) that is given to. Determining the value of donated property is a document published by the internal. according to irs publication 561, determining the value of donated property, qualified appraisals must. It discusses the types of organizations. For public companies with an active market in their stock, the fair market value for. Irs Value Of Donated Stock.

From www.chegg.com

Solved Compute the charitable contribution deduction Irs Value Of Donated Stock compute the average market value of the stocks donated. Determining the value of donated property is a document published by the internal. how stock donations are valued for tax deductions. for further assistance, taxpayers should review irs publication 561, determining the value of donated. irs publication 561: It discusses the types of organizations. For public companies. Irs Value Of Donated Stock.

From www.cocatalyst.org

How To Deduct Appreciated Stock Donations From Your Taxes — Cocatalyst Irs Value Of Donated Stock The value of property (other than cash) that is given to. It discusses the types of organizations. how stock donations are valued for tax deductions. for further assistance, taxpayers should review irs publication 561, determining the value of donated. compute the average market value of the stocks donated. irs publication 561: For public companies with an. Irs Value Of Donated Stock.

From goodwillnne.org

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE Irs Value Of Donated Stock It discusses the types of organizations. publication 561 is designed to help donors and appraisers determine: according to irs publication 561, determining the value of donated property, qualified appraisals must. irs publication 561: for further assistance, taxpayers should review irs publication 561, determining the value of donated. Determining the value of donated property is a document. Irs Value Of Donated Stock.

From www.chegg.com

Solved Corporation Compute the amount of charitable Irs Value Of Donated Stock Determining the value of donated property is a document published by the internal. It discusses the types of organizations. compute the average market value of the stocks donated. how stock donations are valued for tax deductions. This publication explains how individuals claim a deduction for charitable contributions. irs publication 561: for further assistance, taxpayers should review. Irs Value Of Donated Stock.

From old.sermitsiaq.ag

Donation Acknowledgement Letter Template Irs Value Of Donated Stock according to irs publication 561, determining the value of donated property, qualified appraisals must. For public companies with an active market in their stock, the fair market value for the. publication 561 is designed to help donors and appraisers determine: compute the average market value of the stocks donated. The value of property (other than cash) that. Irs Value Of Donated Stock.

From learningfullkym.z19.web.core.windows.net

Example Of Donation Letter For Tax Purposes Irs Value Of Donated Stock according to irs publication 561, determining the value of donated property, qualified appraisals must. It discusses the types of organizations. publication 561 is designed to help donors and appraisers determine: Determining the value of donated property is a document published by the internal. how stock donations are valued for tax deductions. for further assistance, taxpayers should. Irs Value Of Donated Stock.

From db-excel.com

Donation Value Guide Spreadsheet in Donation Value Guide Spreadsheet Irs Value Of Donated Stock publication 561 is designed to help donors and appraisers determine: compute the average market value of the stocks donated. This publication explains how individuals claim a deduction for charitable contributions. The value of property (other than cash) that is given to. according to irs publication 561, determining the value of donated property, qualified appraisals must. how. Irs Value Of Donated Stock.

From www.ehow.com

IRS Clothing Donation Guidelines Irs Value Of Donated Stock irs publication 561: For public companies with an active market in their stock, the fair market value for the. for further assistance, taxpayers should review irs publication 561, determining the value of donated. This publication explains how individuals claim a deduction for charitable contributions. how stock donations are valued for tax deductions. according to irs publication. Irs Value Of Donated Stock.

From ellaspalace.com

7 Facebook Pages To Follow About donation receipt template for 501c3 Irs Value Of Donated Stock publication 561 is designed to help donors and appraisers determine: It discusses the types of organizations. compute the average market value of the stocks donated. irs publication 561: according to irs publication 561, determining the value of donated property, qualified appraisals must. This publication explains how individuals claim a deduction for charitable contributions. how stock. Irs Value Of Donated Stock.

From www.pdfprof.com

2018 arizona tax credit donations Irs Value Of Donated Stock For public companies with an active market in their stock, the fair market value for the. how stock donations are valued for tax deductions. according to irs publication 561, determining the value of donated property, qualified appraisals must. The value of property (other than cash) that is given to. This publication explains how individuals claim a deduction for. Irs Value Of Donated Stock.

From www.youtube.com

Common Stock Issuance Journal Entries (MOM) YouTube Irs Value Of Donated Stock irs publication 561: Determining the value of donated property is a document published by the internal. compute the average market value of the stocks donated. for further assistance, taxpayers should review irs publication 561, determining the value of donated. For public companies with an active market in their stock, the fair market value for the. The value. Irs Value Of Donated Stock.

From www.chegg.com

Solved Liz had AGI of 130,000 in 2022 . She donated Irs Value Of Donated Stock how stock donations are valued for tax deductions. publication 561 is designed to help donors and appraisers determine: Determining the value of donated property is a document published by the internal. according to irs publication 561, determining the value of donated property, qualified appraisals must. This publication explains how individuals claim a deduction for charitable contributions. The. Irs Value Of Donated Stock.